Maverick 2021 there are many advantages of equity financing the most important of which are. Stockholders control will increase.

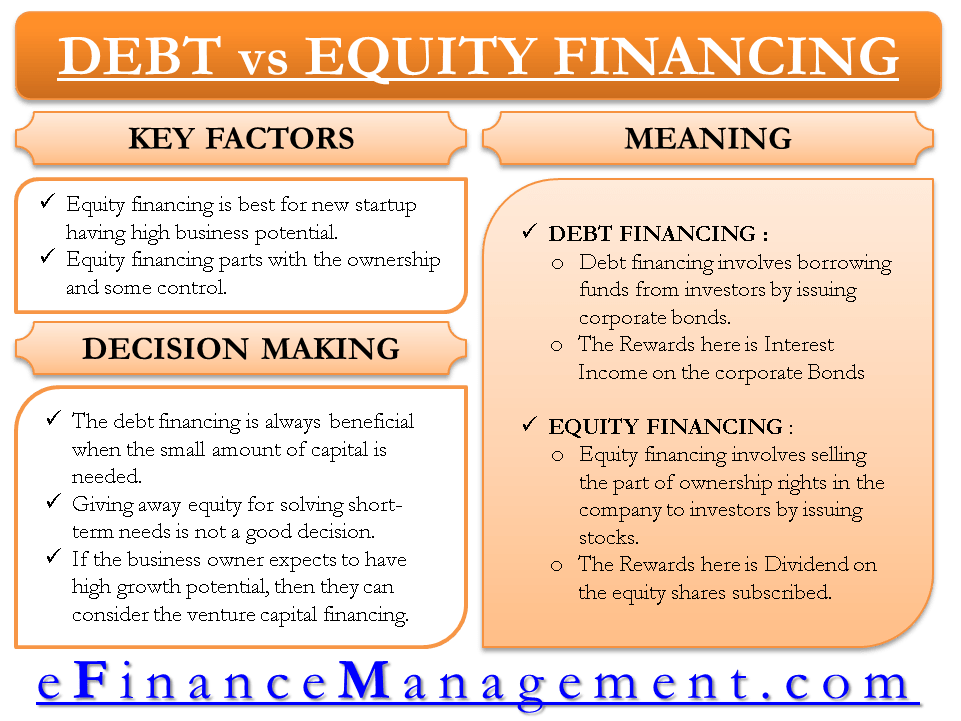

Debt Vs Equity Financing Efinancemanagement

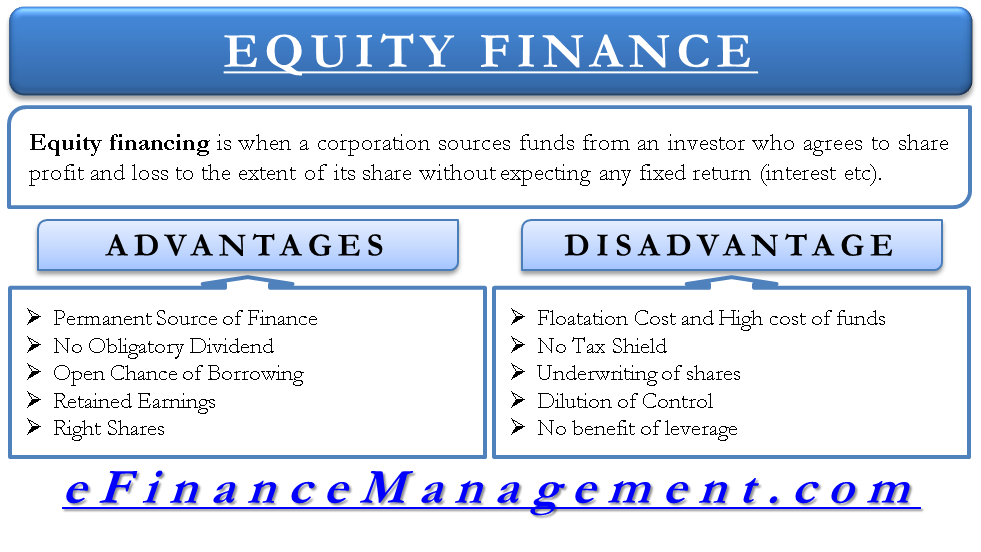

B - Equity does not have to be repaid.

. C dividends are tax deductible. Its often necessary to weigh the pros and cons of any type of financing. There is not a future obligation to repay the capital to.

They can offer outside perspective and expertise to your new business. Your lender may ask for financial statements and information. Dividends are tax deductible.

The business doesnt have to make a monthly loan payment which can be particularly important if the business doesnt initially generate a profit. DIts possible to raise more money than a loan can usually provide Its possible to raise more money than a loan can usually provide - is an advantage of equity financing over debt financing. The main advantage of equity financing is that it offers companies an alternative funding source to debt.

CEquity financing provides necessary capital more quickly than a loan. D stockholders control will increase. Your obligation ends when the debt is repaid.

Your relationship with the lender is mostly transactional. Equity financing is the only way for a company to raise money without adversely impacting the debt ratio. Advantages of equity financing Much higher potential for funding.

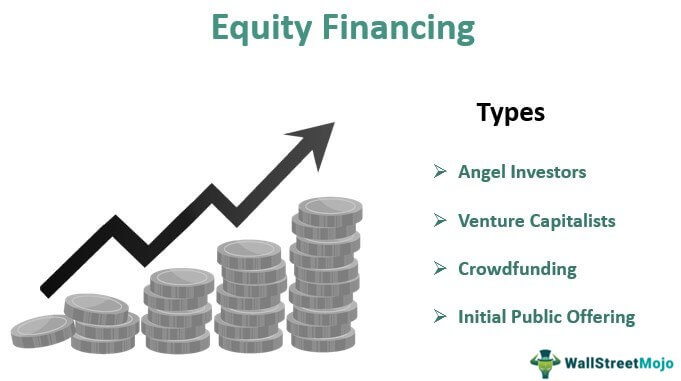

Advantages of Equity Financing Equity financing can bring in more up front capital. Sometimes a strong business plan can be more important than your credit score or years in the business. Startups that may not qualify for large bank loans can acquire funding from angel investors venture capitalists or crowdfunding platforms to cover their costs.

Equity financing does not provide any guarantees that you will actually receive any funding for your business unlike debt financing which always provides a guaranteed amount if. Advantages of equity financing over debt financing include that. No need to repay the principal amount.

Click card to see definition. Interest must be paid on debt. Look at your goals assets and unique situation to determine if debt financing is a viable option for you.

A lender is entitled only to repayment of the agreed-upon principal of the loan plus interest and has no direct claim on future profits of the business. Tap card to see definition. Equity financing isnt financially burdensome.

Advantages of debt financing over equity financing. However he or she has virtually no control over how you spend your time or. If you have a great business idea and find the right investor you can potentially get much more money from equity financing than you could with debt financing.

Advantages of Equity Financing. Advantages of equity financing include the following. Advantages of debt financing over equity.

Advantages of Equity Financing You can use your cash and that of your investors when you start up your business for all the start-up costs instead of making large loan payments to banks or other organizations or individuals. The advantages of using equity financing include. Advantages of Debt Compared to Equity Because the lender does not have a claim to equity in the business debt does not dilute the owners ownership interest in the company.

These funds can expand their stock exposure to 80 per cent depending on equity prices with a minimum of 30 per cent. Get cash without giving up ownership. Tap again to see term.

The remaining funds. Advantages of Debt Financing. This in turn gives you the freedom to channel more money into your growing business.

Debt financing is when you borrow money and pay it back over time with interest. Less risky than debt. Advantages of equity financing over debt financing include that.

Had total assets of 100000 total liabilities of 60000 and stockholders equity of 40000 before repurchasing 1000 shares of its 1 par value common stock for 5 per share. Because you sold a portion of your company shares it was an even exchange of capital and equity. The amount that is.

You dont repay the money the investor provided. 3 hours agoBalanced Advantage Funds are equity mutual fund schemes. Debt financing has a limit depending on your credit and how much youre able to repay but equity financing is limited only by how much your.

Conversely some of the drawbacks associated with debt financing include. Click again to see term. Perhaps the best thing about debt financing is that its temporary.

1-equity financing is a suitable option for owners of high growth companies 2-profits resulting from this financing are considered substantial 3 -the main advantage of equity financing is that there is no obligation to repay the money acquired. A dividends are mandatory. Large payments Negative effect on credit Bankruptcy Increased debt to income ratio.

Page 10 of 15 31 Advantages of equity financing over debt financing include that. B equity financing does not require repayment. A stockholders control will increase B dividends are tax deductibleC dividends are mandatoryD equity financing does not require payment.

Multiple Choice equity financing does not require repayment. Answer to Solved 36. There is no guarantee that the company must repay investors if the company goes bankrupt.

With equity financing there is no loan to repay. Equity financing is when investors pay you for an ownership stake in your company. This is perhaps the greatest advantage of raising money is equity financing.

Debt must be repaid or refinanced. You can build strong lasting relationships with your investors. These include property.

Benefits And Disadvantages Of Equity Finance

Equity Financing Meaning Example Types Of Equity Financing

Senior Debt Vs Corporate Bonds Pros Cons Comparison

Debt Vs Equity Financing What Are The Advantages And Disadvantages Universal Cpa Review

0 Comments